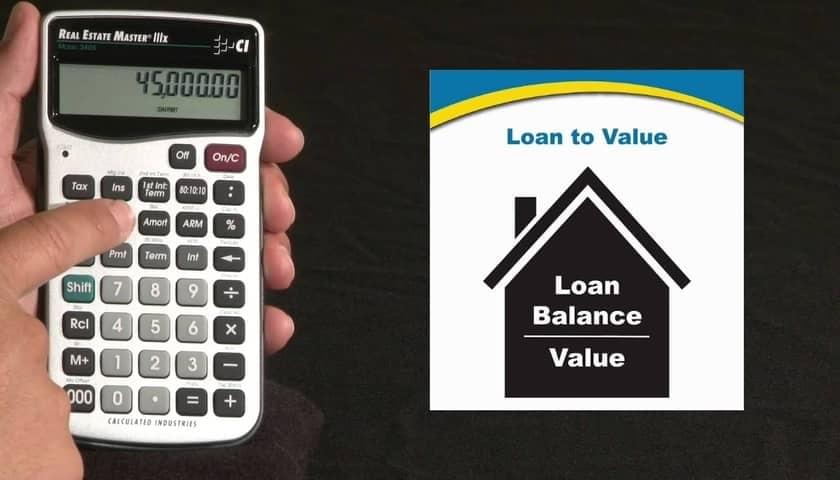

LTV or loan-to-value ratio is used by lending institutions to estimate the amount to be disbursed against a mortgaged land’s value.

Usually, higher LTV ratio indicates more risk as the chances of defaulting increases rapidly. In this regard, a potential borrower can use a loan to value calculator to estimate a property’s value in terms of credit.

What is the formula to calculate loan-to-value ratio?

Individuals applying for a loan against property must look for lenders offering the highest LTV to effectively leverage the equity of their property.

The formula for LTV is (principal amount/market value of a property) X 100.

For instance, a loan application of Rs.60 lakh against the property value of Rs.1 crore will have an LTV ratio of 60%. However, using a loan to value calculator for this estimation would remove chances of errors.

How does LTV work?

This ratio holds a significant role in loan against property in India approval and interest rate.

Ahigher LTV increases the lending risk for financial institutions, who increases the interest significantly. For instance, a borrower with a 90% LTV is required to pay a higher EMI and interest. However, low LTV brings down the interest outgo.

Similarly, other factors like debt to income ratio, credit score, age, income stability helps in availing a suitable LTV. In this regard, an LTV of 80% is considered viable for borrowings.

Hence, potential borrowers must opt for lending institutions offering compatible LTV ratio to optimise their borrowing experience.

Additional Read : What Is Loan-to-value Calculator & How To Use It