One of the easiest and smart ways to avail finance is by liquidating your fixed asset. With the help of experienced lenders the process can be completed in lesser time than the traditional method and with minimum formalities. One such finance is getting loan against property which is comparatively a better option than opting for personal loan.

Leading loan providers such as NBFCs offer up to 60-70% of the loan amount against the value of the collateral. This is actually the maximum amount that can be obtained as per market standards. Thus, it is advised to pledge a property which is free from any litigation and has no existing loan on it.

Existing customers of the loan can avail of the Balance Transfer facility. This lets them get their current EMIs reduced as they can get their loan refinanced to a lower property loan interest rates. While, the tenure gets adjusted according to the new terms and conditions. However, to make the most of this benefits they must have made the existing loan repayments on time and be consistent with them.

You can apply for the loan online with minimum paperwork which includes - copy of documents to be mortgaged, bank account statements, identity proofs.It may be noted that these documents may vary as per the individual profile and requirement of the lender. Besides, lenders offer the doorstep facility to collect these documents so you do not have to waste time in queuing up at the lender’s office.

Lenders such as NBFCs offer the loan on Flexi Hybrid feature. This is a unique facility which lets you borrow as per your needs from the loan amount sanctioned. They charge interest on these daily withdrawals only. This helps to lower the EMIs by up to 45% and manage the loan better.

Additional Read:

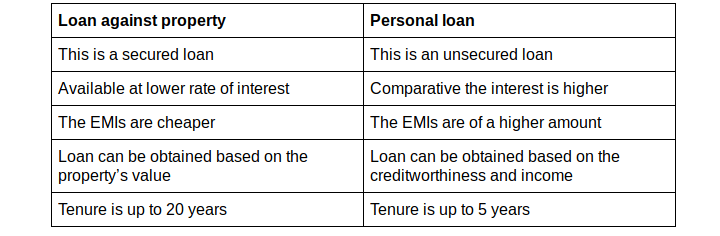

5 Reasons Loan Against Property is Better than Personal Loan

What are the differences between home loan, personal loan & mortgage loan?